Medicare

Schedule a Meeting With Texas Retirement Solutions or Call (806) 242-0550

Are Medicare and Medicaid the same?

No. Sometimes they get confused. Click here to learn more about Medicaid.

Home to Medicare Needs

Medicare has several parts: A, B, C, and D

With few exceptions, this is free. It helps cover inpatient care in hospitals, as well as skilled nursing care, hospice, and home health care. However, it may not pay 100% of these costs.

To cover the difference, you might buy a Medicare insurance Supplement Plan, or Medigap policy. Same thing.

Part B covers doctors’ services, hospital outpatient care, home health care, and some preventive services to help support your health and to keep certain illnesses from getting worse.

Again, to cover the difference, you might buy a Supplement Plan (or Medigap policy).

These are insurance plans offered by private companies that are approved by Medicare.

An Advantage Plan offers all of your Part A and all of your Part B coverage. By law, Medicare Advantage Plans must cover all the services covered by Original Medicare, except hospice.

So what about hospice care? Original Medicare covers that, even if you have an Advantage Plan.

Are Medicare Advantage Plans supplemental coverage? No: see below.

This helps cover the cost of your prescription drugs. Part D is run by private insurance companies that are approved by Medicare. It may not cover the complete cost, but offers a very significant discount.

Advantage Plan or Supplement Plan?

You have two options.

When you turn 65 and go on to Medicare Part B, you come to a fork in the road. You get to choose one path:

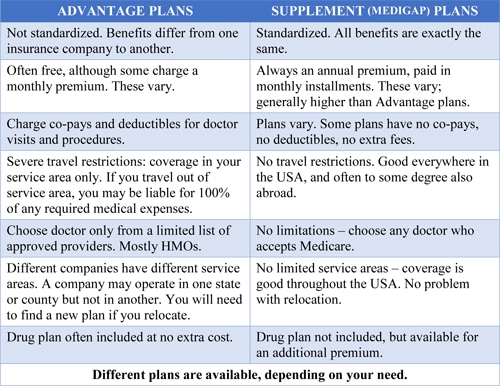

1: If you choose an Advantage Plan (see “Part C” above), you are actually opting out of the Medicare System and choosing a private insurer. Depending on which company you choose, there may or may not be an annual fee, and coverages and co-pays will vary. See the chart.

2: It you choose a Supplement (or Medigap) Plan, you still get to choose a private insurer but, oddly enough, you are staying within the Medicare System. You will pay monthly installments on an annual fee – this varies according to the insurance company you choose – but zero co-pays. See the chart.

When Should I Sign Up?

If you already receive Social Security and are nearing 65, you’ll get your Medicare card in the mail three months before your 65th birthday. If you wait until age 66 or later to apply for Social Security, you should apply for Medicare about three months prior.

How To File for Medicare

You can:

Apply on line at www. Medicare.gov and fill out a Medicare application

You can call Social Security (1-800-772-1213) to sign up for Part A and Part B.

Typically, Medicare coverage starts on the first day of the month that you have your 65th birthday, or choose to accept Medicare Part B.

When Can You Get Medicare?

Your Medicare card will arrive in an envelope from CMS (Centers for Medicare/Medicaid Services). It will have the effective dates of both Part A and Part B already filled in. Keep this – and any further information you receive from CMS – for future reference.

If you don’t want Part B, then follow the card’s instructions and send it back. Otherwise you will have to pay the Part B premium.

Can You Say No to Part B?

Yes. Let’s say you work for a business that has a good medical plan, and you don’t want to lose it after you turn 65. You may decide not to sign up for Part B quite yet. Check with HR to decide what’s best.

Later, when you leave the company, you can contact Social Security and ask for a new card, with your preferred start date for Part B. In most cases, this is the first day of the month after your company health benefits end.

You Get Six Months to Decide

Don’t Let This Time Slip By

From the time you go on Part B, you have only six months for the Open Enrollment Period. During this time you have the guaranteed right to:

1: enroll in any Medicare Advantage Plan available in your service area, or

2: buy any Medicare Supplement (Medigap) policy sold in your state.

You cannot be turned down for coverage during this time. But it only comes around once.

When this six-month period is over, your option to buy a Supplement policy may be limited, it may cost you more, and you will probably have to pass medical tests to apply for one in the future.

How to Choose between Advantage and Supplemental Plans?

Start by answering these Eight Vital Questions:

- If I choose a Medicare Advantage Plan, are my present doctors on it?

- When I get sick, do I want to be confined to a doctor in my local service area, or can I choose the best doctor I can find anywhere in the country?

- Relative to Question 2, do I plan to travel outside my local area?

- What will my monthly premium be?

- How much is my co-pay when I see my doctor or other provider?

- Must I pay deductibles for my doctor or a hospital? If so, how much?

- If I’m admitted into a network hospital, do I have to pay a portion of the daily room rate? If so, how much?

- How much will I have to pay if I’m admitted into an out-of-network hospital?

Call Thad Wellshear

(785) 213-0740

Taking the mystery out of Medicare, helping maximize your social security benefits!

Have any Question? Ask us anything, we’d love to answer!

(806) 242-0550

Medicare Made Easy, Medicare Made Simple.

If you feel like you have been spinning your wheels wondering how to make the best decision when it comes to your Medicare plan, you are in the right place. The good news is, you don’t have to do this alone. We are in the business of helping people understand Medicare, in simple, plain terms that everyone can understand. We believe it’s important that your first understand Medicare itself. You can’t understand your Medicare options until you first understand basic Medicare benefits. Fortunately, we’ve mastered how to make it simple.

Financial Services

Insurance Services

Educational Blogs

Medicare

Texas Retirement Solutions Location

Amarillo, Texas

5801 W. Interstate 40, Suite 101

Amarillo, TX 79106

(806) 242-0550