Schedule a Meeting With Texas Retirement Solutions or Call (806) 242-0550

“Third-Party Posts”

3 Social Security Changes Retirees Need to Know About in 2025

Key Points A modest cost-of-living adjustment (COLA) will make benefit checks bigger. Note that higher earners will pay a bit more in Social Security taxes. Retirees...

If you’re nearing retirement, these 2025 changes could affect your finances. Here’s what to know

Key Points If you’re nearing retirement, key changes for 2025 could affect your finances, according to advisors. Starting in 2025, there’s a higher 401(k) plan catch-up...

A Checklist for Retiring in 2025

Our checklist for retiring next year includes everything you need to do before the retirement party. Only you can know if you're ready for a checklist for retiring in...

Social Security’s full retirement age is increasing in 2025. Here’s what to know.

Most Americans may consider the standard retirement age to be 65, but the so-called "full retirement age" for Social Security is already older than that — and it's...

5 Key Changes to 401(k)s in 2025 and What They Mean for You

These new rules could make it easier for you to save more money for retirement Participating in a 401(k) plan where you work is a smart way to invest for retirement....

What’s Changing for Retirement in 2025?

How Secure 2.0 and inflation adjustments will affect retirement savers and spenders. For retirement savers, the ringing in of the new year will bring more than the...

Most Americans Feel They’re Worse Off Now Than In 2020—Here’s What The Data Says

Key Takeaways A recent Gallup poll showed most Americans feel they are worse off today than four years ago. Data on household finances show that things have changed...

Retirees’ Credit Card Debt Levels Are Climbing

Key Takeaways An Employee Benefit Research Institute survey found that more than two-thirds of retirees had outstanding credit card debt in 2024, up from 40% in 2022....

3 Big Retirement Rule Changes Are Coming in 2025—How They Could Affect Your Savings

Key Takeaways Some provisions related to the Secure 2.0, a federal retirement law, will go into effect in 2025. Workers ages 60, 61, 62, or 63 will be able to make...

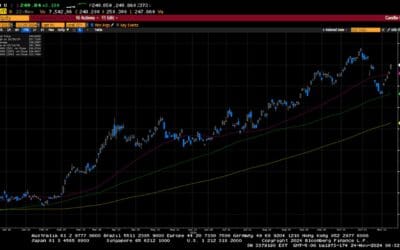

Weekly Market Commentary

-Darren Leavitt, CFA Financial markets advanced this week as a solid start to the fourth-quarter earnings season, and some better-than-feared inflation data gave...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets fell in the first full week of 2025 as investors recalibrated their Federal Reserve monetary policy expectations. Stronger labor...

Weekly Market Commentary

-Darren Leavitt, CFA The final trading sessions for 2024 extended losses from the prior week, but the S&P 500 and NASDAQ still posted impressive gains for the year,...

Weekly Market Commentary

-Darren Leavitt, CFA Market action was mixed in a holiday-shortened week of trade. The Santa Clause rally, which runs for the last five trading sessions of the year...

Weekly Market Commentary

-Darren Leavitt, CFA Equity and fixed-income markets sold off for the second consecutive week as the Federal Reserve delivered an expected twenty-five basis-point rate...

Weekly Market Commentary

-Darren Leavitt, CFA The Nasdaq eclipsed the 20,000 level for the first time this week as investors reengaged in buying the mega-cap technology names. Amazon, Google,...

Weekly Market Commentary

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate...

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 and Dow rise to new all-time highs. Investors cheered the nomination of Scott Bessent as Treasury...

Weekly Market Commentary

-Darren Leavitt, CFA Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Hollie Gandy) or (Texas Retirement Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Texas Retirement Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Weekly Market Commentary

US markets rebounded from losses in the prior week as trade tensions between the US and China appeared to ease. President Trump is scheduled to meet with President Xi...

QCDs and RMDs Before Roth Conversions: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: I read your blog titled “5 Things You Need to Know About Qualified Charitable Distributions.” I was surprised that you didn’t...

Good Reasons to Name a Trust as IRA Beneficiary

When a trust is named as beneficiary of an IRA, several possible negative issues may be introduced. For example, after the death of the IRA owner, things can become...

State Tax Treatment of 529-to-Roth IRA Rollovers

By Ian Berger, JD IRA Analyst By now, most of you probably know about the SECURE 2.0 Act provision permitting 529 funds to be rolled over to Roth IRAs. Because of this...

Roth Conversions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Hello Ed Slott Team! I have been doing backdoor Roth IRA conversions for years now. I recently inherited...

5 Steps for Tax-Free Roth IRA Distributions

By Sarah Brenner, JD Director of Retirement Education The benefit of funding a Roth IRA is the availability of tax-free distributions in the future. You pay taxes now...

401(k) RMD Rollover Problems…and a Last-Minute Save!

By Andy Ives, CFP®, AIF® IRA Analyst 401(k) custodians are usually pretty good about distributing required minimum distributions (RMDs) from the plans they oversee....

Another Way to Lose IRA Bankruptcy Protection

By Ian Berger, JD IRA Analyst Normally, if you declare bankruptcy, your IRA funds (traditional and Roth) are completely off limits to bankruptcy creditors. But a recent...

October 15 Deadlines Are Approaching

By Sarah Brenner, JD Director of Retirement Education October is almost here. This means fall is in full swing. Along with pumpkin spice lattes, football season, and...

What You’ll Pay in Out-of-Pocket Medicare Costs in 2025

“How much can I expect to pay out of pocket for Medicare coverage?” It’s something you might be wondering if you’re age 65+ or about to turn 65. Medicare expenses are a big concern for many older adults, especially those on a fixed or limited income. The first step to...

read more

The Medicare Part D Donut Hole Disappears in 2025

Key takeaways: The Medicare Part D coverage gap known as the “donut hole” will end in 2024. As of January 1, 2025, Medicare Part D plans will have a $2,000 out-of-pocket limit. If you reach that threshold, your plan will pay for all of your covered medications in full...

read more

What You Need to Know About Changes to Medicare Part D in 2025

Two important changes are coming for Medicare Part D beneficiaries in 2025 as a result of the Inflation Reduction Act: Annual out-of-pocket (OOP) cap of $2,000 for prescription drugs. Medicare Prescription Payment Plan (MPPP), which will allow beneficiaries who opt in...

read more

Medicare benefits in 2025: 4 big changes every enrollee should know

Big changes are coming to Medicare in 2025, and they could make a major difference in your prescription drug costs. Thanks to the Inflation Reduction Act, Medicare beneficiaries will see the most significant updates to the program’s drug coverage since it was first...

read more

CMS Announces 2025 Premiums and Deductibles for Medicare Parts A and B

Last week, the Centers for Medicare & Medicaid Services (CMS) released information about Medicare costs in 2025, including the 2025 premium, deductible and coinsurance amounts for Medicare Part A and Part B. The agency also announced the income-related monthly...

read more

Comparing Plans is Especially Important This Open Enrollment Season Due to Changes in Part D Protections and New Options

Key components of the Inflation Reduction Act’s Part D reforms will be fully implemented for plans offered in 2025. These changes, including the total elimination of the “coverage gap” coverage period, the establishment of a $2,000 cap on beneficiary out-of-pocket...

read more

CMS Finalizes Payment Rule, Including Update to the Custody Definition

Medicare payment rules prohibit coverage for a service if a beneficiary is not financially responsible for the care or if another government entity is obligated to provide or pay for the item or service. For years, the Medicare rules interpreting and implementing this...

read more

Health Care Access Improving in Rural Areas, Challenges Persist

A new report from the U.S. Department of Health and Human Services’ (HHS) Office of the Assistant Secretary for Planning and Evaluation (ASPE) examines trends in health care access and outcomes in rural America. While insurance rates in these areas are improving,...

read more

Millions See Cost Savings Under the Inflation Reduction Act

The Inflation Reduction Act (IRA) made significant improvements to Medicare prescription drug access and affordability, including by restructuring the Part D benefit to limit enrollee expenses. Those changes began in January 2024, when the IRA eliminated cost sharing...

read more

What You’ll Pay in Out-of-Pocket Medicare Costs in 2025

“How much can I expect to pay out of pocket for Medicare coverage?” It’s something you might be wondering if you’re age 65+ or about to turn 65. Medicare expenses are a big concern for many older adults, especially those on a fixed or limited income. The first step to...

The Medicare Part D Donut Hole Disappears in 2025

Key takeaways: The Medicare Part D coverage gap known as the “donut hole” will end in 2024. As of January 1, 2025, Medicare Part D plans will have a $2,000 out-of-pocket limit. If you reach that threshold, your plan will pay for all of your covered medications in full...

What You Need to Know About Changes to Medicare Part D in 2025

Two important changes are coming for Medicare Part D beneficiaries in 2025 as a result of the Inflation Reduction Act: Annual out-of-pocket (OOP) cap of $2,000 for prescription drugs. Medicare Prescription Payment Plan (MPPP), which will allow beneficiaries who opt in...

Medicare benefits in 2025: 4 big changes every enrollee should know

Big changes are coming to Medicare in 2025, and they could make a major difference in your prescription drug costs. Thanks to the Inflation Reduction Act, Medicare beneficiaries will see the most significant updates to the program’s drug coverage since it was first...

CMS Announces 2025 Premiums and Deductibles for Medicare Parts A and B

Last week, the Centers for Medicare & Medicaid Services (CMS) released information about Medicare costs in 2025, including the 2025 premium, deductible and coinsurance amounts for Medicare Part A and Part B. The agency also announced the income-related monthly...

Comparing Plans is Especially Important This Open Enrollment Season Due to Changes in Part D Protections and New Options

Key components of the Inflation Reduction Act’s Part D reforms will be fully implemented for plans offered in 2025. These changes, including the total elimination of the “coverage gap” coverage period, the establishment of a $2,000 cap on beneficiary out-of-pocket...

CMS Finalizes Payment Rule, Including Update to the Custody Definition

Medicare payment rules prohibit coverage for a service if a beneficiary is not financially responsible for the care or if another government entity is obligated to provide or pay for the item or service. For years, the Medicare rules interpreting and implementing this...

Health Care Access Improving in Rural Areas, Challenges Persist

A new report from the U.S. Department of Health and Human Services’ (HHS) Office of the Assistant Secretary for Planning and Evaluation (ASPE) examines trends in health care access and outcomes in rural America. While insurance rates in these areas are improving,...

Millions See Cost Savings Under the Inflation Reduction Act

The Inflation Reduction Act (IRA) made significant improvements to Medicare prescription drug access and affordability, including by restructuring the Part D benefit to limit enrollee expenses. Those changes began in January 2024, when the IRA eliminated cost sharing...